Avail Your Discount Now

Discover an amazing deal at www.economicshomeworkhelper.com! Enjoy a generous 10% discount on all economics homework, providing top-quality assistance at an unbeatable price. Our team of experts is here to support you, making your academic journey more manageable and cost-effective. Don't miss this chance to improve your skills while saving money on your studies. Grab this opportunity now and secure exceptional help for your economics homework.

We Accept

- Government Expenditure

- Public versus private expenditure

- Increasing government expenditure

- Public expenditure in the UK

- Attempts to cut public expenditure

- The impact of increased public expenditure on the PSBR

- Control of public expenditure

- Public expenditure planning

- Principles of taxation

- Fundamental taxation principles

Government Expenditure

It is fairly common in older economics textbooks to find that public (or state) expenditure and the expenditure of an individual are considered analogous. Economists likened the spending of the nation to that of a family man, who decides how to spend his income after he has received it. In the case of a modern government, however, the process works the other way around. The government decides what its expenditure shall be, and then considers how it should secure the necessary revenue. This can sometimes be very confusing for new students. The best of understanding the concept and solving assignments is to avail help with economics homework.

The common idea that the primary purpose of taxation is to enable the government to pay its bills is one of the most tenacious fallacies that shackle the human mind' (Professor Kenneth E. Bouldin. of Peace, Prentice Hall Inc., 1946). Although the UK is only a relatively highly taxed country (see Table 8.1), we have not reached a state of 'taxable capacity' and the British taxpayer may be compared to a lemon from which a little more juice may continually be squeezed.

Public expenditure is equal in size to about half of our national output and includes all spending by government departments and local authorities and capital expenditure by the nationalized industries and other public corporations (together with the debt interest they pay to the private sector). It involves the expenditure of many kinds: investment in the construction of roads; incentives for industrial expansion in the development areas; the cost of the armed forces, police, teachers, hospital staff, and other public servants in both central and local government; and fixed investment by the nationalized industries, ranging from the construction of nuclear power stations to the purchase of aircraft and railway rolling stock. In addition, the public sector has to pay interest on money that it has borrowed. About 60 percent of all public spending is undertaken directly by the central government and nearly 30 percent by local authorities; about 10 percent represents expenditure by public corporations. About 66 percent of public spending is financed through taxes: taxes on income and property, and taxes on expenditure (value-added tax, or VAT), including motor vehicle license duties and the rates levied by local authorities. Other sources of government revenue include national insurance and health contributions, trading income (e.g., from the nationalized industries), income from property, and borrowing.

Public versus private expenditure

The delimitations, between what should be provided by the individual and what should be provided by the community as a whole, are arbitrary. In common parlance, one often hears such expressions as "They should provide...' or 'Such things ought to be free'. 'They' presumably refers to the Government, either central or local, and by 'free' the speaker means that the things under consideration should be provided from government expenditure. Economic goods are not free, but have a monetary value; even the supply of water has to be paid for, to defray the costs of reservoirs, filtration equipment, piping, etc. There are those committed to welfare economics, who would argue that housing and public transport should be free in the sense of being provided for by the community. It is a matter of allocation and choice whether housing ought to be paid for by public or private expenditure. In the UK, we opt for a middle-of-the-road course, whereby most people live in so-called private houses (although the full ownership may be a matter of 25 years hence), while the remainder rent houses from private landlords or live in council houses. The majority of people expect education, hospitals, and libraries to be free but expect to pay for a theatre seat or a swim. It could be argued that swimming is more beneficial than reading, and therefore swimming pools should be provided for public expenditure. Frequently it is a question of whether or not it is economically possible to collect a tax; for example, it is easier to make a charge for a motor car passing through the Dartford Tunnel or across the Forth Bridge than for one traveling for an unspecified distance along a motorway.

Table 8.1 Taxes and social security contributions as a percentage of the economy (GNP)

| Including social security contributions | 1970 (%) | (Rank) | 1979 (%) | (Rank) | Excluding social security contributions | 1970 (%) | (Rank) | 1979 (%) | (Rank) |

| Norway | 48 | 1 | 56 | 1 | Norway | 37 | 3 | 42 | 1 |

| Sweden | 46 | 2 | 55 | 2 | Sweden | 38 | 1 | 40 | 2 |

| Netherlands | 44 | 3 | 54 | 3 | Belgium | 27 | 8 | 34 | 3 |

| Belgium | 39 | 7 | 48 | 4 | Australia | 28 | 6 | 34 | 4 |

| France | 41 | 5 | 47 | 5 | Finland | 31 | 5 | 34 | 5 |

| German Federal Republic | 39 | 6 | 34 | 6 | UK | 37 | 2 | 34 | 6 |

| UK | 39 | 6 | 44 | 7 | Netherlands | 28 | 7 | 33 | 7 |

| Finland | 36 | 9 | 39 | 8 | Canada | 34 | 4 | 31 | 8 |

| Itlay | 30 | 10 | 35 | 9 | German Federal Republic | 27 | 9 | 27 | 9 |

| Canada | 37 | 8 | 35 | 10 | France | 27 | 10 | 27 | 10 |

| Australia | 28 | 11 | 34 | 11 | Greece | 21 | 11 | 23 | 11 |

| Greece | 28 | 11 | 32 | 12 | Switzerland | 19 | 12 | 22 | 12 |

| Switzerland | 25 | 13 | 31 | 13 | Italy | 19 | 13 | 21 | 13 |

| Japan | 21 | 14 | 27 | 14 | Japan | 17 | 14 | 19 | 14 |

Increasing government expenditure

In 1890, Adolph Wagner framed his law relating to the growth of public expenditure. In Finanzwissenschaft, Wagner stated that the Law of Increasing State Activity is the result of observation, at least in most Western European countries, and that although financial stringency may hamper the extension of government activities at certain times, in the long run, the desire for public services will overcome these financial difficulties.

Further to Wagner's Law of Increasing State Activity, the time may come when all houses will be fitted with central heating or free telephones, i.e., paid for by government expenditure. After all, few people in the year 1800 would have thought that education or hospitals could be provided for free. The whole argument revolves around a person's concept of what should be provided by the State and what should be provided by the direct users of the product or service.

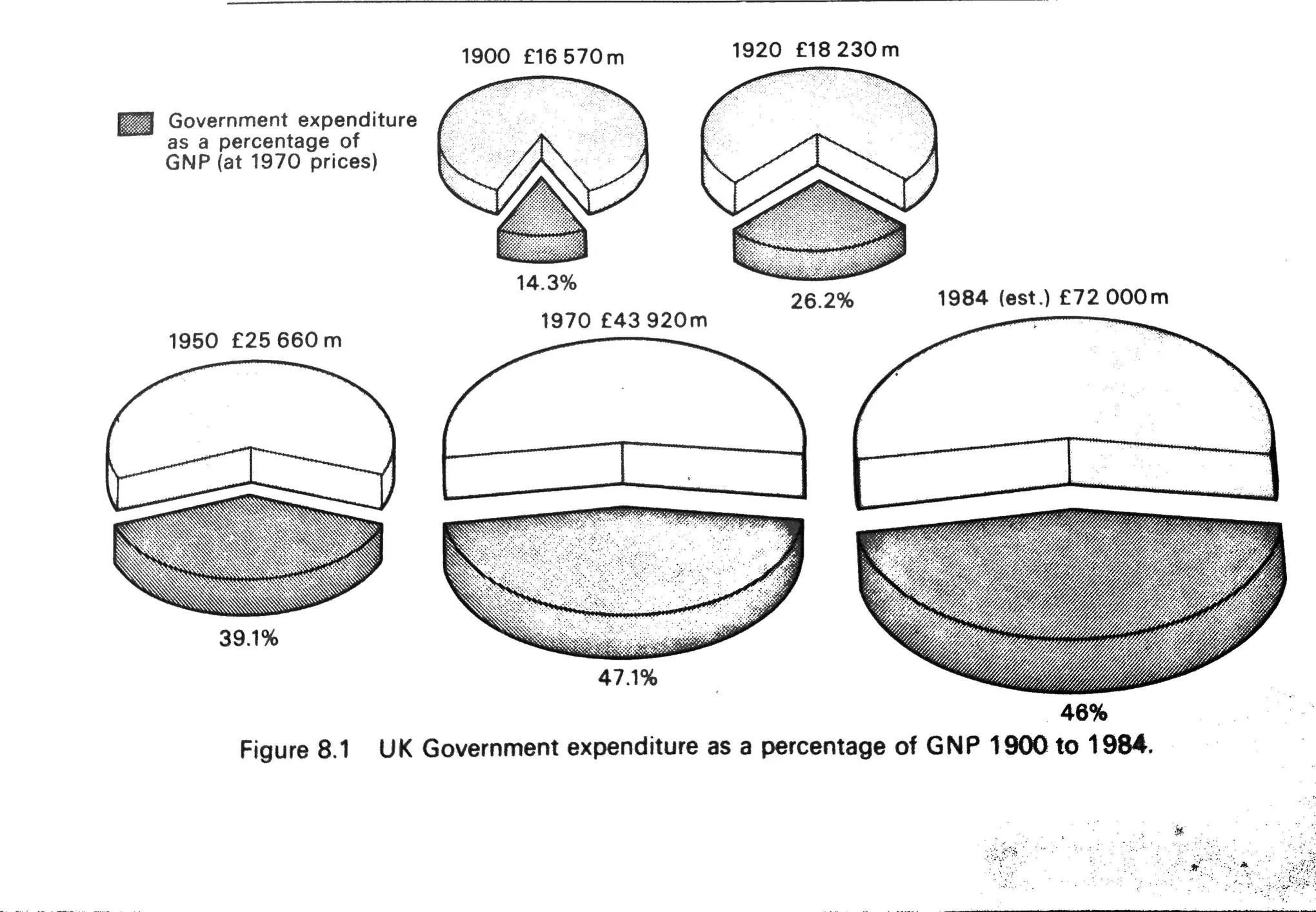

In the UK in the last 80 years, government expenditure has increased enormously. Table 8.2 and Fig. 8.1 show government expenditure as a percentage of GNP.

In the early nineteenth century, the Government's only large social expense was the Poor Law which rose to £8 million in 1834 but gradually declined after the harsh Poor Law Amendment Act of that year. In 1833, the Government made its first annual grant to education of £20 000, but it was not until the Forster Act of 1870 that education became compulsory in Britain and large increases in educational expenditure began. Liberal Governments from 1906 caused vast increases in government expenditure through the introduction of old age pensions, unemployment and sickness benefits, etc.

Table 8.2 Government expenditure as a percentage of GNP 1890 to 1981

| 1890 | 1900 | 1920 | 1932 | 1951 | 1968 | 1984(est.) |

| 8 | 14 | 26 | 29 | 39 | 47 | 46 |

Public expenditure in the UK

- Social security.

- Health and personal social services.

- Education and science, arts, and libraries.

- Defense and external relations.

- Housing.

- Debt interest.

| Date | Expenditure |

| 1900 | 134 |

| 1938 | 1000 |

| 1954 | 5000 |

| 1969 | 13000 |

| 1974 | 23000 |

| 1981 | 75000 |

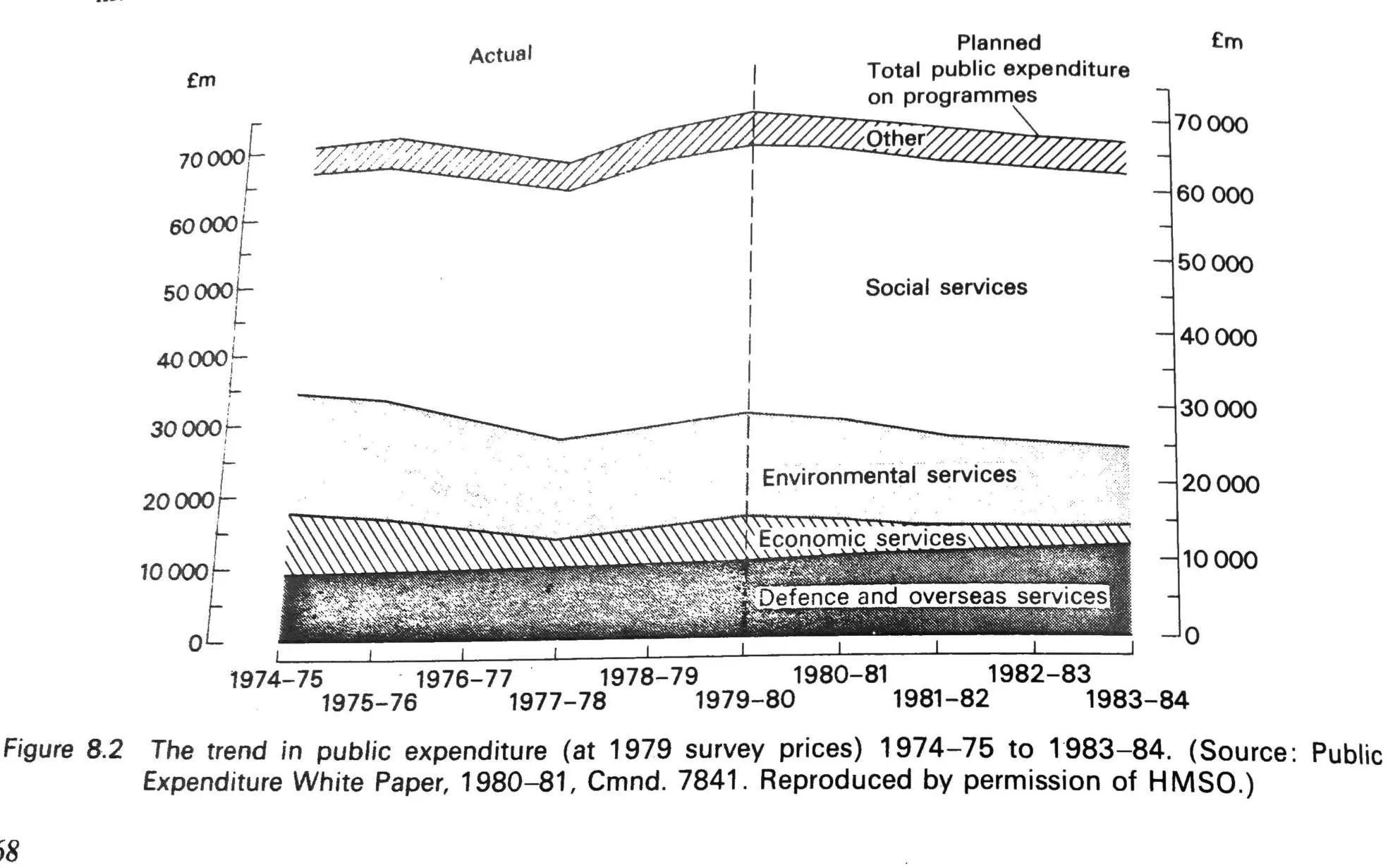

Attempts to cut public expenditure

- The Government's policies relating to expenditure cuts intensified the trade recession and thus increased expenditure on social services.

- Although large savings were expected in expenditure upon industry and commerce, the large numbers of bankruptcies forced the Government to make industry and employment expenditure the areas of most rapid growth.

- Public spending increased faster than anticipated in the Government's political priority areas of defense and law and order.

- Public expenditure ceilings were not maintained for social services, education, and general local authority spending.

- The Government's monetarist policies caused interest rates to increase to unprecedented levels and this added to the cost of servicing the public sector's debt.

- Higher unemployment increased unemployment and supplementary benefits and payments from the Redundancy Fund and brought a higher take-up of special employment measures.

- Larger loans had to be made to nationalized industries and state-supported firms because their internal finance (generated largely by sales revenue) was diminished by the fall in aggregate demand in the economy.

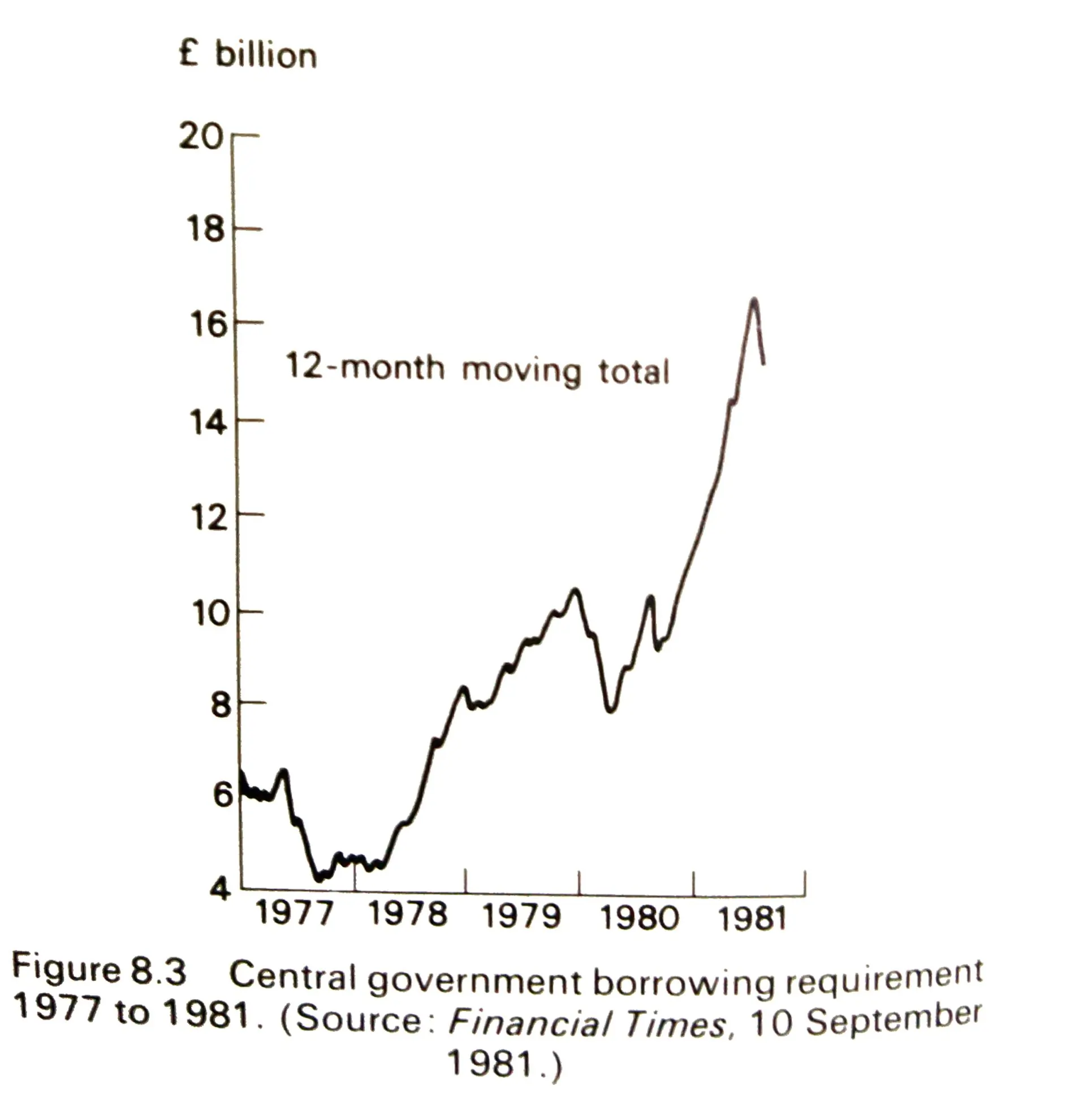

The impact of increased public expenditure on the PSBR

| 1978-79 | 1979-80 | 1980-81 | 1981-82 | 1982-83 | 1983-84 | |

| Total Expenditure | 74.0 | 74.5 | 74.5 | 73 | 71 | 70.5 |

| Total Receipts | -65.0 | -66 | -67.5 | -67.5 | -69.5 | -71 |

| GGBR | 9.0 | 8.5 | 7 | 5.5 | 4 | 3 |

| PSBR | 9.3 | 8 | 6 | 5 | 3.5 | 2.5 |

| PSBR as % of GDP at market prices | 5.5 | 4.75 | 3.75 | 3 | 2.25 | 1.5 |

Control of public expenditure

- To ensure that money is spent as Parliament intended.

- To ensure the exercise of the due economy.

- To maintain high standards of public morality in all financial matters.

Public expenditure planning

- Ministers discuss the cash that will be spent, and therefore what will have to be financed by taxation or borrowing, instead of talking about 'funny money'-the amount which could be misleadingly different from the resultant cash spent.

- Expenditure figures can be related more readily to the revenue projections, so that 'finance can determine expenditure and not expenditure finance'.

- Changes in public sector costs are brought into the discussion. The previous constant price system did not bring out the effect of, for example, the rapid relative rise in public service pay in 1979-80 resulting from the Clegg Commission and other comparability awards. Nor, conversely, did it enable the planning figures to reflect the Government's stance on public service pay since then.

- Previously, the "volume' plans that is, plans in constant prices-were regarded by spending managers as entitlements, carried forward from year to year regardless of what was happening to costs. This meant that program managers had little incentive to adapt their expenditures in response to increasing relative costs, except in the short term in response to the annual cash limits. The presumption now shifts in favor of maintaining planned cash expenditure, rather than a given 'volume of provision regardless of cost.

- The decisions in the annual survey, as they relate to the year ahead, can be translated directly into the cash limits and estimates presented to Parliament, without revaluation from one price basis to another.

Principles of taxation

Fundamental taxation principles

- Equality This does not mean that each taxpayer should contribute an equal amount but rather, for example, that two single men earning £4000 a year should pay the same income tax, providing they have similar responsibilities. Taxes should be universal, imposed without distinction upon those 'similarly placed. The State must have no favorites, so all cigarette smokers must pay the tax on cigarettes.

- Economy It is in the best interests of both the Government and the taxpayers that taxes should be collected as economically as possible. It would be possible to impose a small tax on cat owners or cyclists, but the cost of collecting these taxes might amount to more than the revenue collected. Adam Smith wrote that taxes should: 'be so contrived as both to take out and to keep out of the pockets of the people as little as possible, over and above what it brings into the public treasury of the State".

- Certainty It is often contended that the British tax system is so complicated that it is too difficult for ordinary citizens to understand. However, although there may be complex details that have to be mastered by businessmen and investors, the average man should have little difficulty in calculating his tax dues. Adam Smith put the principle in this way: The tax that each individual is bound to pay ought to be certain and not arbitrary. The form of payment, the manner of payment, and the quantity to be paid ought all to be clear and plain to the contributor and every other person.

- Convenience Adam Smith wrote: 'A tax will be easier to administer if its object and time of payment are related to the habits of the community. The PAYE tax is the most convenient because it is collected by the employer before the employee receives his pay. Local taxes have been criticized because householders usually receive a Rate Demand Note every six months, so many ratepayers have to "scrape the bottom of the barrel' to pay, while others are summoned for not paying on time. However, ratepayers can pay in installments if they so desire. Schedule D tax is inconvenient for writers, artists, and those who gain fees for professional services because they receive lump-sum tax demands. Writers may spend years on a single work, earning nothing while it is still unfinished. Then, when it is finished, they receive a sale fee or royalty payment for it, which brings their income for that one year up to a level where they pay a great deal of personal direct taxation.

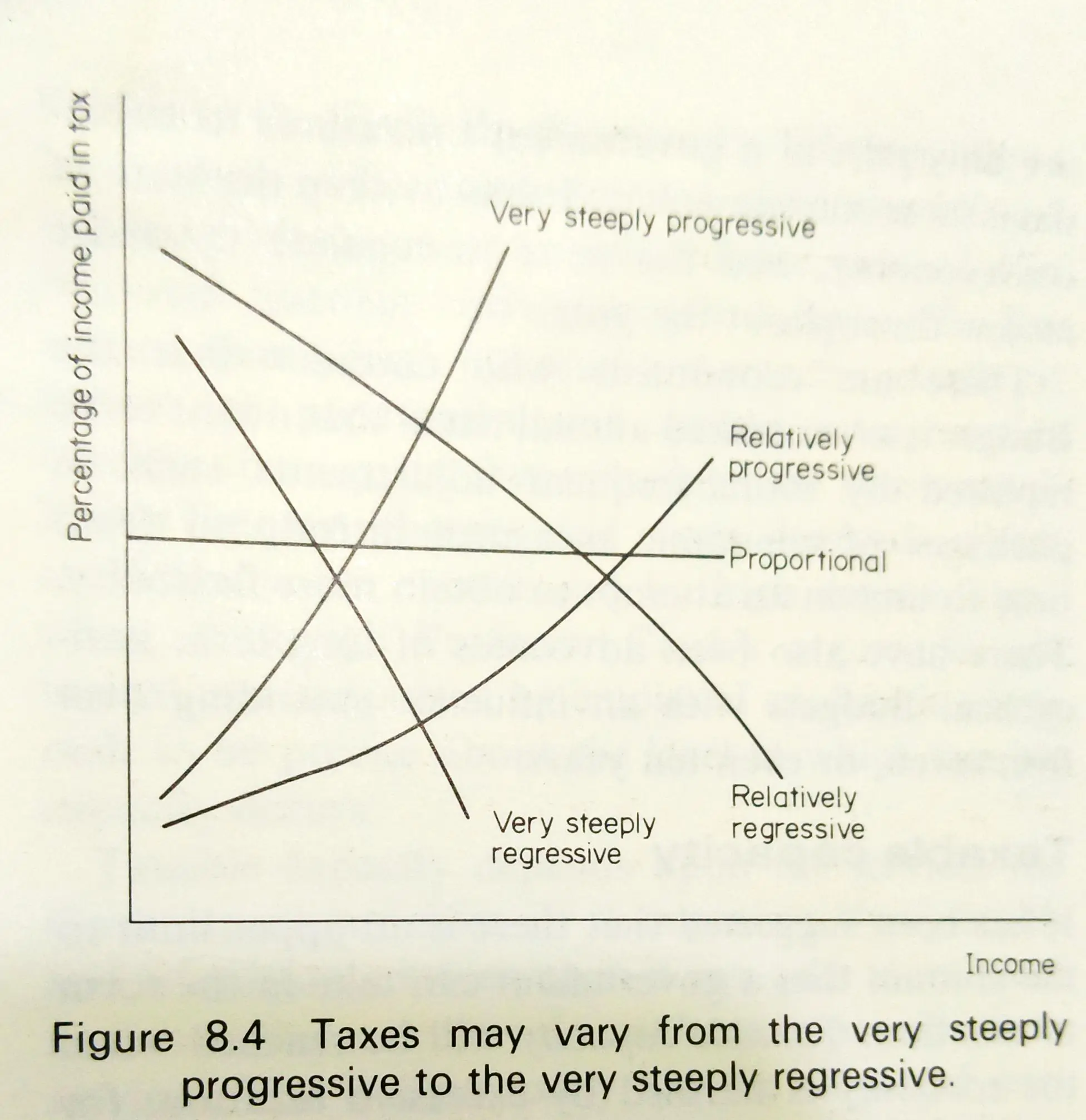

- Efficiency Where possible, taxes should help to promote the economic efficiency of a country. Taxation helps to control the level of demand and may thus be used as part of a reflationary policy or an attempt to reduce inflation; thus any tax that impinges heavily on consumption relative to saving will probably be more effective in curbing inflation. The amount of government revenue extracted in various spheres must be kept below taxable capacity. High rates of tax may dissuade a man from working overtime; therefore, the economy suffers from excessive taxation. Taxes may vary from the steeply progressive to the steeply regressive (see Fig. 8.4). A regressive tax is a tax whose incidence falls more upon the poor. Thus if the tax on petrol is 90p per gallon, this is more burdensome to a man earning £5000 a year compared with a man earning £15000 a year. An ad valorem tax is less regressive because it is proportional to price...

- Ability to pay Taxes ought to be geared to a person's ability to pay, i.e., the burden of taxation should fall upon those who can bear it, upon the rich more than on the poor (progressive taxation). The ability to pay may serve as a useful, rough judgment but it is not a precise criterion. Moreover, it is a principle more applicable to taxation as a whole than to a particular tax; a single tax should not be condemned as regressive if the tax system as a whole provides a 'satisfactory' degree of progression. (Professor C. T. Sandford, Taxation, Institute of Economic Affairs.)

- Social considerations The government today uses the tax structure to level out the inequalities of income. The National Health Service is maintained mainly from taxation, and many social security benefits come from the same source. Social security contributions are logically included as part of taxation in the broadest sense because they are compulsorily levied by governments, and public social security schemes must be regarded as an instrument of public policy. For the UK, these contributions comprise contributions to the national insurance scheme, the industrial injuries scheme, the National Health Service, and the Redundancy Fund. Employers' contributions to social security are akin to a tax on expenditure on wages and salaries as far as the employer is concerned. Attempts have been made to justify progressive taxation according to the Law of Diminishing Marginal Utility. It has been argued that a man earning £100 per week would gain more from an extra £l than a man earning £1000 a week, i.e., the more of a thing one has the less satisfaction one gains from an additional unit of it. However, it is not possible to judge the benefit each gain from £1: 'satisfaction' is a very subjective thing and although an individual may compare satisfactions gained from different commodities, it is not possible to measure satisfaction An extra £l to a drug addict may result in death El to another man may mean a theatre ticket and great satisfaction. So although progressive taxation may be thought socially and politically desirable, it cannot be supportable on grounds of economics alone. Similarly, the "costs and surplus' concept is far from foolproof. The idea that an individual has a certain 'cost' of living and the 'surplus' can be taxed is a very arbitrary one.

- Equity A distinction ought to be made between equity and equality. An acceptance of the principle of equity would lead to a higher rate of taxation being imposed upon 'unearned' than upon 'earned" income.